Introduction to Global Supply Chain Disruptions

Definition of Supply Chain Disruptions

Supply chain disruptions refer to interruptions in the flow of goods and services. These disruptions can arise from various factors, including natural disasters, geopolitical tensions , and technological failures. Such events can lead to significant delays and increased costs for businesses. It’s crucial to understand these dynamics. They can impact profitability and operational efficiency.

For instance, consider the following factors:

Each of these can severely affect supply chains. Awareness is key. Businesses must adapt to these challenges. They should develop robust contingency plans. This is indispensable for maintaining competitiveness.

Historical Context and Recent Events

Historically, supply chain disruptions have been influenced by various global events. For example, the 2008 financial crisis significantly impacted trade flows. This led to increased scrutiny of supply chain vulnerabilities. Understanding these historical contexts is essential. They provide insights into current challenges.

Recent events, such as the COVID-19 pandemic, have further exacerbated these issues. Lockdowns disrupted manufacturing and logistics worldwide. This resulted in unprecedented delays and shortages. Businesses faced significant operational hurdles. Awareness of these trends is vital. He must adapt to survive.

Impact of COVID-19 on Supply Chains

The COVID-19 pandemic profoundly disrupted global supply chains. Lockdowns halted production and restricted transportation. This led to significant delays in product availability. Many businesses faced inventory shortages. He must recognize these challenges. They are critical for strategic planning.

Additionally, demand fluctuations created further complications. Some sectors experienced surges, while others declined. This imbalance strained existing supply networks. Understanding these dynamics is essential. It helps in makijg informed decisions.

Importance of Understanding Supply Chain Dynamics

Understanding supply chain dynamics is crucial for businesses. It enables effective risk management and strategic planning. Knowledge of these factors can prevent costly disruptions. He must stay informed about market trends. This awareness fosters resilience in operations. Adaptability is key in today’s environment.

Key Factors Contributing to Supply Chain Disruptions

Geopolitical Tensions and Trade Wars

Geopolitical tensions and trade wars significantly impact supply chains. Tariffs and sanctions can disrupt established trade routes. This leads to increased costs and delays. He must consider these factors in planning. They affect both sourcing and distribution strategies. Awareness is essential for effective decision-making. Understanding these dynamics is crucial.

Natural Disasters and Climate Change

Natural disasters and climate change pose significant risks to supply chains. Events such as hurricanes, floods, and wildfires can disrupt production and logistics. These disruptions lead to increased costs and delays. He must assess these risks carefully. They can affect inventory levels and customer satisfaction. Preparedness is essential for minimizing impacts. Understanding these threats is vital.

Technological Failures and Cybersecurity Threats

Technological failures and cybersecurity threats can severely disrupt supply chains. System outages may halt production and logistics operations. This results in financial losses and reputational damage. He must prioritize cybersecurity measures. They are essential for protecting sensitive data. Awareness of these risks is crucial. Preparedness can mitigate potential impacts.

Labor Shortages and Workforce Challenges

Labor shortages and workforce challenges significantly impact supply chains. Insufficient staffing can lead to production delays and increased operational costs. He must address these workforce issues promptly. They affect overall efficiency and service levels. Understanding labor market dynamics is essential. This knowledge aids in strategic workforce planning. Adaptability is crucial in this environment.

Implications for Businesses

Operational Challenges and Increased Costs

Operational challenges lead to increased costs for businesses. Disruptions in supply chains can result in higher expenses. He must evaluate these financial implications carefully. They can bear on profit margins and pricing strategies. Understanding these challenges is essential for effective management. Awareness fosters better decision-making and planning. Cost control is vital for sustainability.

Impact on Inventory Management

The impact on inventory management is significant for businesses. Disruptions can lead to stockouts or excess inventory. This imbalance affects cash flow and operational efficiency. He must monitor inventory levels closely. Accurate forecasting is essential for minimizing risks. Understanding market trends aids in better planning. Effective inventory management is crucial for success.

Changes in Consumer Behavior and Demand

Changes in consumer behavior significantly impact businesses. Shifts in demand can lead to inventory challenges. He must adapt to these fluctuations quickly. Understanding consumer preferences is essential. This knowledge informs product development and marketing strategies. Awareness of trends is crucial for success. Flexibility is key in this environment.

Long-term Strategic Planning Considerations

Long-term strategic planning is essential for businesses. It allows for proactive responses to market changes. He must consider various factors, including economic trends and consumer behavior. This foresight aids in resource allocation and risk management. Developing a flexible strategy is crucial for adaptability. Awareness of potential disruptions is vital for sustainability. Strategic planning fosters resilience in operations.

The Role of Cryptocurrency in Supply Chain Management

Blockchain Technology qnd Transparency

Blockchain technology enhances transparency in supply chain management. It provides a decentralized ledger that records transactions securely. This transparency fosters trust among stakeholders. He must leverage this technology for efficiency. Improved traceability can reduce fraud and errors. Understanding blockchain’s potential is essential for innovation. It can transform operational processes significantly.

Smart Contracts for Automation

Smart contracts facilitate automation in supply chain processes. They execute predefined conditions without human intervention. This reduces the risk of errors and delays. He must implement these contracts for efficiency. Automation streamlines operations and enhances productivity. Understanding their functionality is crucial for businesses. They can significantly lower operational costs.

Cryptocurrency as a Payment Solution

Cryptocurrency serves as an innovative payment solution in supply chains. It enables faster transactions across borders with lower fees. He must consider its benefits for cash flow. This flexibility enhances liquidity and reduces reliance on traditional banking. Understanding cryptocurrency’s role is essential for modern businesses. It can streamline payment processes significantly. Efficiency is key in today’s market.

Case Studies of Successful Implementations

Several companies have successfully implemented cryptocurrency in their supply chains. For instance, a logistics firm utilized blockchain for tracking shipments. This enhanced transparency and reduced fraud significantly. He must analyze these successful models. They demonstrate the potential for efficiency gains. Understanding these case studies is crucial for strategic planning. They provide valuable insights into best practices.

Risk Mitigation Strategies for Businesses

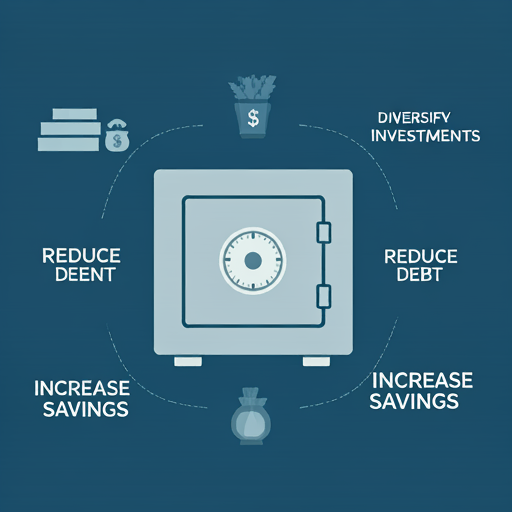

Diversification of Supply Sources

Diversification of supply sources is essential for risk mitigation. It reduces dependency on a single supplier, enhancing resilience. He must evaluate potential suppliers across various regions. This strategy minimizes disruptions from geopolitical or environmental factors. Understanding market dynamics is crucial for effective sourcing. It fosters competitive pricing and quality assurance. Flexibility is vital in supply chain management.

Investment in Technology and Innovation

Investment in technology and innovation is crucial for risk mitigation. Advanced systems enhance operational efficiency and reduce errors. He must prioritize adopting new technologies. This can lead to significant cost savings over time. Understanding the latest trends is essential for competitiveness. It fosters adaptability in a changing market. Innovation drives growth and sustainability.

Building Stronger Relationships with Suppliers

Building stronger relationships with suppliers enhances risk mitigation. Collaborative partnerships foster trust and reliability. He must engage in regular communication. This ensures alignment on expectations and goals. Understanding supplier capabilities is essential for effective collaboration. It can lead to better pricing and service. Strong relationships improve overall supply chain resilience.

Utilizing Data Analytics for Better Decision Making

Here are 10 trending article titles for a financial website based on the latest news and analysis of financial trends: No input data

Future Trends in Global Supply Chains

Increased Adoption of Digital Solutions

Increased adoption of digital solutions is transforming supply chains. Technologies like AI and IoT enhance efficiency and visibility. He must embrace these innovations for competitiveness. They streamline trading operations and reduce costs. Understanding digital trends is essential for future success. This shift fosters agility in responding to market changes. Adaptability is crucial in this evolving landscape.

Shift Towards Localized Supply Chains

The shift towards localized supply chains is gaining momentum. This trend enhances resilience against global disruptions. He must consider the benefitw of proximity. Reduced transportation costs and shorter lead times are significant advantages. Understanding local market dynamics is essential for effective sourcing. It fosters stronger community relationships and supports sustainability. Localized supply chains can improve responsiveness to consumer demands.

Emergence of Sustainable Practices

The emergence of sustainable practices is reshaping supply chains. Companies are increasingly prioritizing eco-friendly materials and processes. He must evaluate the long-term benefits of sustainability. This approach can enhance brand reputation and customer loyalty. Understanding regulatory requirements is essential for compliance. It fosters innovation and operational efficiency. Sustainable practices can reduce overall costs significantly.

Integration of AI and Machine Learning

Integration of AI and machine learning is transforming supply chains. These technologies enhance predictive analytics and decision-making processes. He must leverage data for improved efficiency. This can lead to significant cost reductions. Understanding AI applications is essential for competitiveness. It fosters innovation and agility in operations. Automation can streamline repetitive tasks effectively.

Regulatory and Compliance Considerations

Understanding Global Trade Regulations

Understanding global trade regulations is essential for compliance. These regulations govern international transactions and tariffs. He must stay informed about changes. Non-compliance can lead to significant penalties. Awareness of trade agreements is crucial for strategic planning. It can enhance market access and competitiveness. Knowledge of regulations fosters better decision-making.

Impact of Cryptocurrency Regulations

The impact of cryptocurrency regulations is significant for businesses. Compliance ensures legal operation within the market. He must understand the evolving regulatory landscape. Non-compliance can result in severe penalties. Awareness of these regulations fosters trust with stakeholders. It also enhances operational transparency. Knowledge is crucial for strategic planning.

Compliance with Environmental Standards

Compliance with environmental standards is essential for businesses. It ensures sustainable practices and reduces ecological impact. He must stay informed about relevant regulations. Non-compliance can lead to fines and reputational damage. Understanding these standards fosters corporate responsibility. It also enhances consumer trust and loyalty. Awareness is crucial for long-term success.

Preparing for Future Regulatory Changes

Preparing for future regulatory changes is crucial for businesses. He must anticipate shifts in compliance requirements. Proactive strategies can mitigate potential risks. Staying informed about industry trends is essential. This knowledge aids in strategic planning and resource allocation. Flexibility is key in adapting to new regulations. Awareness fosters resilience in operations.

Conclusion and Call to Action

Summary of Key Points

The key points emphasize the importance of compliance. He must prioritize understanding regulations and trends. Proactive strategies can mitigate risks effectively. Staying informed fosters better decision-making. Awareness enhances operational resilience and efficiency. It is essential for long-term success. Take action to ensure compliance today.

Encouragement for Businesses to Adapt

In today’s dynamic market, businesses must adapt to thrive. Flexibility is key for long-term success. Consider the rapid advancements in skincare technology. Staying updated can enhance product efficacy.

Investing in research and development is crucial. It leads to innovative solutions. This can significantly boost customer satisfaction. Happy customers return for more.

Embrace digital transformation to reach wider audiences. Online platforms are essential for growth. They provide valuable insights into consumer behavior. Understanding your audience is vital.

Take action now to stay competitive. The future favors the adaptable. Change is the only constant.

Importance of Staying Informed on Trends

Staying informed on trends is essential for professionals. It allows him to anticipate market shifts. This knowledge can lead to strategic advantages. Understanding trends enhances decision-making processes.

Moreover, he can identify emerging opportunities. Recognizing these can drive innovation. Adaptability is crucial in a fast-paced environment. Change is inevitable in any industry.

He should prioritize continuous learning. Knowledge is power in today’s world.

Final Thoughts on the Future of Supply Chains and Cryptocurrency

The integration of cryptocurrency into supply chains presents significant opportunities. It enhances transparency and reduces transaction costs. This can streamline operations effectively. Moreover, blockchain technology ensures data integrity. Secure transactions build trust among stakeholders.

Additionally, real-time tracking improves inventory management. Efficient logistics can lead to cost savings. Companies must adapt to these innovations. Change is essential for future competitiveness.

He should explore these advancements now. The future is rapidly approaching.