Introduction to the Federal Reserve’s Role

Understanding the Federal Reserve System

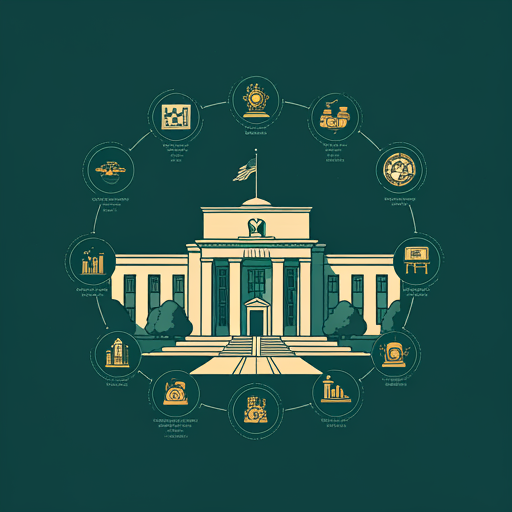

The Federal Reserve plays a crucial role in the U.S. economy. It serves as the central bank, overseeing monetary policy and regulating financial institutions. This system aims to promote maximum employment, stable prices, and moderate long-term interest rates. Understanding its functions is essential for grasping economic trends. Knowledge is power.

The Federal Reserve influences the economy through various tools. These include setting interest rates and conducting open market operations. By adjusting these rates, it can either stimulate or cool down economic activity. This balance is vital for economic health. It’s fascinating how interconnected everything is.

Additionally, the Federal Reserve provides financial services to the government and other institutions. It acts as a bank for banks, ensuring stability in the financial system. This role is often overlooked but is fundamental. Stability is key in finance.

In summary, the Federal Reserve’s decisions impact everyone. Its policies can affect inflation, employment, and overall economic growth. Awareness of these factors can help individuals make believe informed financial choices. Stay informed and proactive.

The Importance of Monetary Policy

Monetary policy is a fundamental tool for managing economic stability. It involves the regulation of money supply and interest rates to influence economic activity. Effective monetary policy can mitigate inflation and reduce unemployment. This is crucial for sustainable growth. Stability fosters confidence.

The Federal Reserve employs various strategies, such as open market operations and the discount rate. These mechanisms directly affect liquidity in the banking system. Increased liquidity can stimulate investment and consumption. This is a key driver of economic expansion. Understanding these mechanisms is essential.

Moreover, the transmission of monetary policy impacts consumer behavior and business investment. Lower interest rates typically encourage borrowing and spending. This can lead to higher demand for goods and services. Demand drives economic growth. It’s a cycle worth noting.

In addition, the credibility of the Federal Reserve influences market expectations. A well-anchored inflation target can stabilize long-term interest rates. This predictability is vital for financial planning. Predictability reduces uncertainty.

Key Components of Monetary Policy

Interest Rates and Their Impact

Interest rates are a critical component of monetary policy, influencing various economic factors. They determine the cost of borrowing and the return on savings. Changes in interest rates can have widespread effects on consumer spending, business investment, and overall economic growth. Understanding these dynamics is essential.

When interest rates rise, borrowing costs increase. This typically leads to reduced consumer spending and lower business investments. Conversely, lower interest rates encourage borrowing and spending. The following table illustrates these effects:

The relationship between interest rates and inflation is also significant. Higher rates can help control inflation by reduving demand. This is crucial for maintaining price stability. Price stability is vital for economic health.

Additionally, interest rates affect currency value. Higher rates often attract foreign investment, strengthening the currency. A strong currency can impact exports and imports. This interconnectedness is noteworthy. Understanding these relationships is essential for informed decision-making.

Quantitative Easing Explained

Quantitative easing (QE) is a non-traditional monetary policy tool used by central banks to stimulate the economy. It involves the large-scale purchase of financial assets, such as government bonds and mortgage-backed securities. By increasing the money supply, QE aims to lower interest rates and encourage lending. This process can lead to increased consumer spending and investment. It’s a complex mechanism.

Furthermore, QE can influence asset prices. As central banks buy assets, their prices typically rise, which can enhance wealth effects. Higher asset prices may encourage consumers to spend more. This relationship is crucial for economic recovery. Recovery is essential for growth.

Additionally, QE can impact inflation expectations. By signaling a commitment to maintaining low rates, central banks can help anchor inflation expectations. This is vital for long-term economic stability. Stability fosters confidence in the market.

However, the effectiveness of QE is debated among economists. Some argue it can lead to asset bubbles and income inequality. These concerns warrant careful consideration. Awareness is important in financial decision-making.

Recent Monetary Policy Decisions

Analysis of Recent Rate Changes

Recent monetary policy decisions have significantly impacted interest rates, reflecting the central bank’s response to economic conditions. In the past few months, the Federal Reserve has adjusted rates to address inflationary pressures. These changes aim to stabilize prices while promoting economic growth. Stability is crucial for long-term planning.

Moreover, the decision to raise rates is often influenced by various economic indicators, including employment figures and consumer spending. For instance, a robust job market can lead to increased wage growth, which may contribute to inflation. This relationship is essential to understand. Awareness is key.

Additionally, market reactions to rate changes can be immediate and pronounced. Stock prices may fluctuate as investors reassess their portfolios in light of new interest rate environments. This volatility can create opportunities and risks. It’s important to stay informed.

Furthermore, the implications of these rate changes extend beyond immediate financial markets. They can affect borrowing costs for consumers and businesses alike. Higher rates typically lead to increased loan costs, which may dampen spending. This cycle is significant for economic health. Understanding these dynamics is vital for informed decision-making.

Market Reactions and Implications

Market reactions to recent monetary policy decisions have been swift and multifaceted. Following announcements of interest rate changes, equity markets often experience volatility. Investors reassess their positions based on anticipated economic conditions. This reassessment can lead to significant price fluctuations. Awareness is crucial.

For instance, when the Federal Reserve raised rates, sectors such as technology and consumer discretionary typically faced downward pressure. Conversely, financial stocks often benefit from higher rates due to improved net interest margins. The following table summarizes these sector reactions:

Additionally, bond markets react differently to rate changes. Rising rates generally lead to falling bond prices, impacting fixed-income investors. This inverse relationship is fundamental to bond market dynamics. Understanding this is essential.

Moreover, currency markets can also be influenced by monetary policy shifts. A stronger dollar may emerge as higher rates attract foreign capital. This can affect export competitiveness. Competitiveness is vital for economic growth. Overall, these market reactions highlight the interconnectedness of financial systems.

The Intersection of Cryptocurrency and Monetary Policy

How Crypto Markets Respond to Fed Decisions

Crypto markets often react sharply to Federal Reserve decisions regarding monetary policy. When the Fed signals a tightening of monetary policy, cryptocurrencies may experience increased volatility. This reaction stems from investor sentiment and the perceived risk associated with digital assets. Risk is a key factor.

For instance, higher interest rates can lead to a stronger U. dollar, which may negatively impact the appeal of cryptocurrencies as alternative investments. As the dollar strengthens, investors may prefer traditional assets. This shift can result in decreased demand for cryptocurrencies. Demand drives market dynamics.

Additionally, the relationship between inflation and cryptocurrency is significant. If the Fed’s actions are perceived as insufficient to combat rising inflation, investors may flock to cryptocurrencies as a hedge. This behavior reflects a growing belief in digital assets as a store of value. A store of value is essential for long-term investment.

Moreover, regulatory developments influenced by Fed decisions can also impact crypto markets. Increased scrutiny or possible regulations may create uncertainty, leading to market sell-offs. Uncertainty can drive volatility. Understanding these interactions is crucial for navigating the crypto landscape.

The Future of Digital Assets in a Changing Economic Landscape

The future of digital assets is increasingly intertwined with monetary policy and economic conditions. As central banks adapt their strategies, cryptocurrencies may face both challenges and opportunities. For instance, if inflation persists, digital assets could be viewed as a hedge against currency devaluation. This perspective is gaining traction among investors. Awareness is essential.

Moreover, regulatory frameworks are evolving in response to the growing prominence of cryptocurrencies. Governments are considering how to integrate digital assets into existing financial systems. This integration could enhance legitimacy and stability. Stability is crucial for investor confidence.

Additionally, technological advancements will poay a significant role in shaping the future of digital assets. Innovations such as blockchain technology can improve transaction efficiency and security. These improvements may attract more institutional investors. Institutional interest is vital for market growth.

Furthermore, the interplay between traditional finance and digital assets will likely intensify. As financial institutions explore cryptocurrency offerings, the landscape will become more competitive. Competition can drive innovation and better services. Understanding these dynamics is important for strategic investment decisions.

Leave a Reply